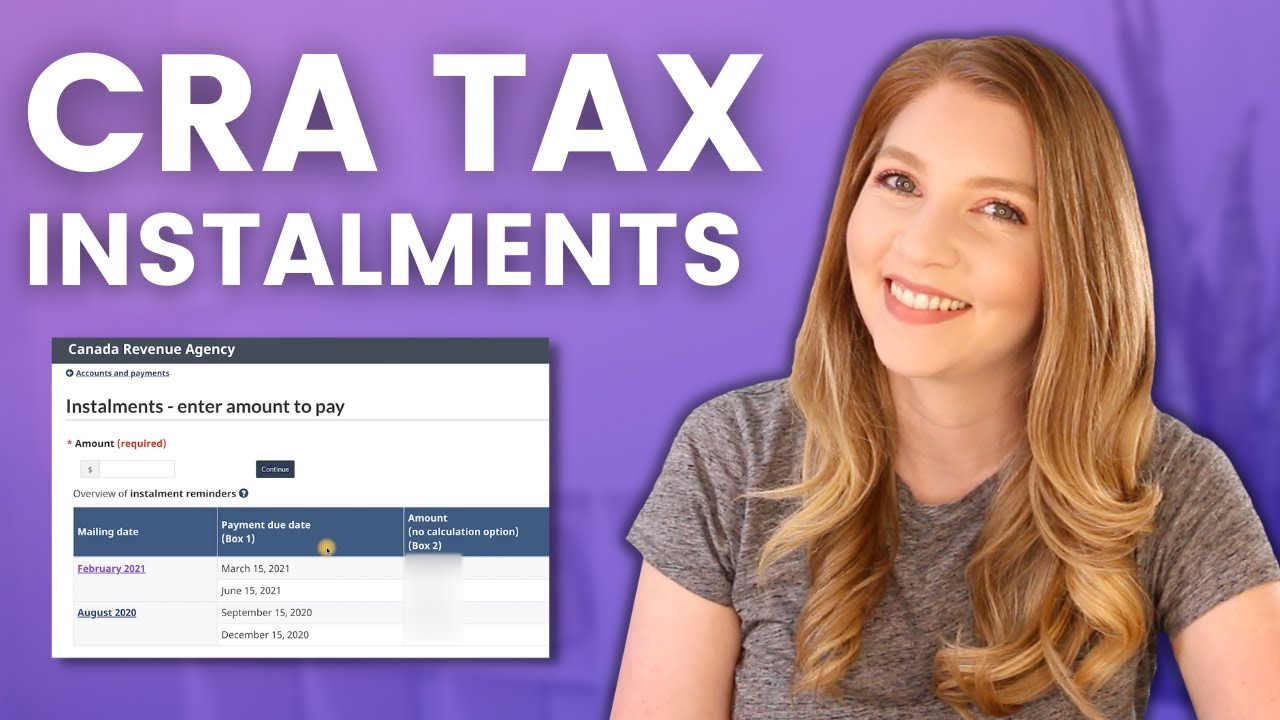

For most taxpayers, the first few months of the year can seem to involve a seemingly unending series of bills and payment deadlines. During January and February, many Canadians are still trying to pay off the bills from holiday spending. The first income tax instalment payment of 2025 is due on March 17, and the need to pay any tax balance for the 2024 tax year comes just six weeks after that, on April 30. Added to all of that, the deadline for making an RRSP contribution for 2024 falls on March 3, 2025.

February 2025 - Akler Browning LLP

The Canadian tax system casts a very wide net, in which each resident of Canada is taxable on all sources of income worldwide, with very few exceptions. In addition, Canada has what is known as a “self-assessing” system, in which Canadian residents voluntarily file an annual tax return on which they report all income earned during the previous year, claim any available deductions and credits, and pay any resulting amount of tax owing.

While virtually every working Canadian pays income taxes, the process by which those taxes are collected throughout the year is largely invisible to the taxpayer. That’s certainly the case for employees, because income taxes (and other statutory deductions like Canada Pension Plan contributions and Employment Insurance premiums) are, as required by law, deducted by the employer from every dollar of salary or wages paid, and remitted to the federal government on the employee’s behalf. The net amount remaining after such deductions is then paid to the taxpayer. Tax amounts withheld and remitted in this way are recorded on the employee’s T4 slip for the year, and credit for the total of tax amounts paid through such payroll deductions throughout the year is then claimed by the employee on their annual return.

For most Canadian retirees, careful financial management is a necessity. Most live on an annual income which is less than that which they enjoyed during their working years, and opportunities to increase that income in any significant way are limited. As well, in recent years, inflation (especially with respect to food and shelter costs) has meant that more and more of that income must be allocated to necessities.