While virtually every working Canadian pays income taxes, the process by which those taxes are collected throughout the year is largely invisible to the taxpayer. That’s certainly the case for employees, because income taxes (and other statutory deductions like Canada Pension Plan contributions and Employment Insurance premiums) are, as required by law, deducted by the employer from every dollar of salary or wages paid, and remitted to the federal government on the employee’s behalf. The net amount remaining after such deductions is then paid to the taxpayer. Tax amounts withheld and remitted in this way are recorded on the employee’s T4 slip for the year, and credit for the total of tax amounts paid through such payroll deductions throughout the year is then claimed by the employee on their annual return.

tax instalment Archives - Akler Browning LLP

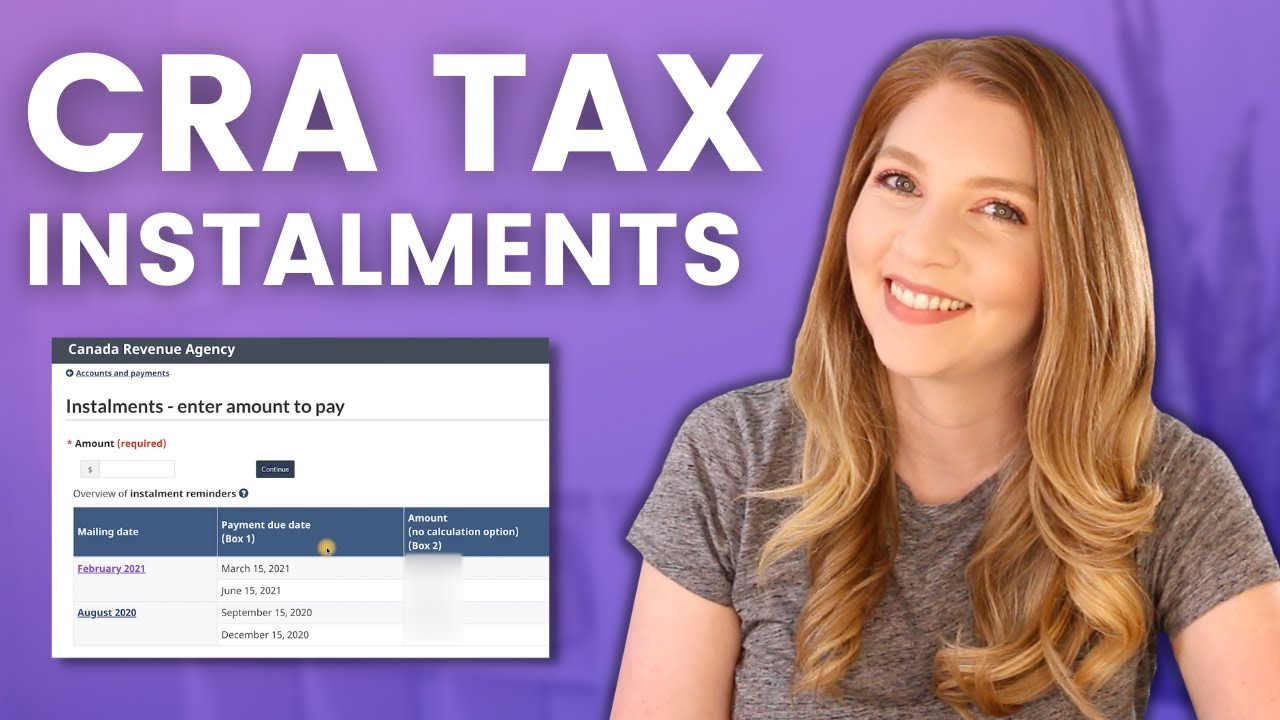

Sometime during the month of February, millions of Canadians will receive some unexpected mail from the Canada Revenue Agency (CRA). That mail, entitled simply “Instalment Reminder”, will set out the amount of instalment payments of income tax to be paid by the recipient taxpayer by March 15 and June 15 of this year.

Sometime during the month of February, millions of Canadians will receive mail from the Canada Revenue Agency. That mail, a “Tax Instalment Reminder”, will set out the amount of instalment payments of income tax to be paid by the recipient taxpayer by March 15 and June 15 of this year.

Sometime during the month of February, millions of Canadians will receive mail from the Canada Revenue Agency (CRA). That mail, a “Tax Instalment Reminder”, will set out the amount of instalment payments of income tax to be paid by the recipient taxpayer by March 15 and June 15 of this year.